Housing & COVID-19: ‘Waves’ of evictions are likely in Fort Wayne as the pandemic continues

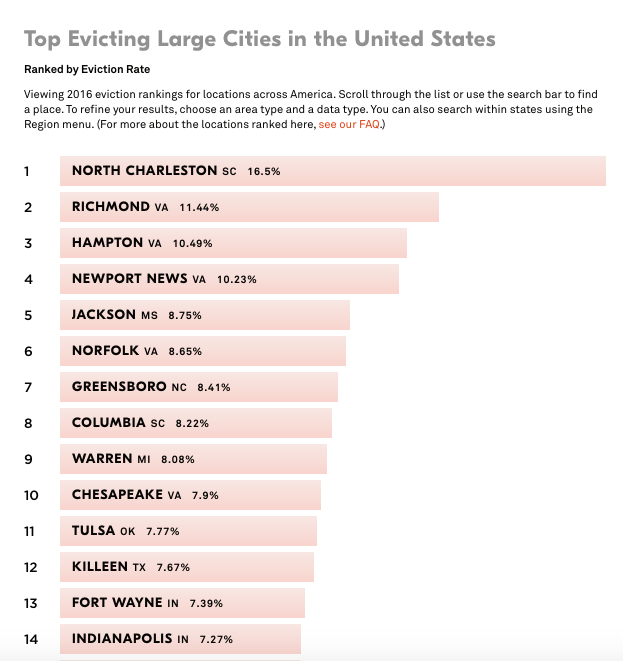

Before COVID-19, Fort Wayne had the 13th highest eviction rate in the U.S. Now, the situation is becoming more complex.

This story exploring how communities across the U.S. are evolving during the COVID-19 pandemic is made possible with funding from Google’s Journalism Emergency Relief Fund.

The COVID-19 pandemic has impacted almost every aspect of life for people worldwide. Almost 9 million cases of COVID in the United States have taken the lives of well over 200,000 people. In recent weeks, Indiana has been regularly setting new record highs for the number of residents testing positive for the coronavirus. The same trend holds true for Allen County. With no clear or unified plan for how to slow the spread of the virus, Americans have had to adapt to a continuously evolving “new normal.”

The pandemic has thrown the sort of wrench in the works that makes previously easy situations difficult and already difficult situations nearly impossible. One example of the latter is Indiana’s eviction crisis.

Before COVID-19 began, the state’s 7.3 percent eviction rate was higher than the national average of 2.3 percent. In 2016, Fort Wayne had the 13th highest eviction rate in the country at 7.39 percent. By 2019, discussions were taking place locally to strategize ways to reduce the eviction rate and provide assistance to both landlords and tenants.

Then COVID-19 began. As people lost jobs and money, the number of evictions was primed to skyrocket. Several eviction moratoriums were put in place to help keep tenants in their homes as well as help reduce the possibility of spreading and contracting the coronavirus that could come from thousands of people being displaced from their homes.

In March, the federal CARES Act issued a 120-day eviction moratorium that expired on July 24. That moratorium, however, solely covered federally financed rental units, which only make up approximately one in four rental units in the U.S. Because of that, many renters had to rely on state and local moratoriums, many of which ended shortly after the federal moratorium expired, including Indiana’s, which ended on August 14.

Currently, there is a federal eviction moratorium issued by the Centers for Disease Control and Prevention (CDC) that expires at the end of the year, but even that has its challenges. According to reporting from the Washington Post, “Because of the order’s wording, which gives local judges room for interpretation, and pushback from landlords, evictions have continued.” The protections are not automatic. Instead, they are subject to interpretation by state and local courts, and they give landlords ways around the moratorium.

Seth Bennett, a Mortgage Loan Originator for Hallmark Home Mortgage, sees firsthand the housing predicament that Fort Wayne is in.

According to Bennett, Fort Wayne’s property values are traditionally rather stagnant, but that also means that in a downward market, property values don’t fall as drastically as they do in other areas. So when the pandemic began and the economy began to nosedive, Fort Wayne’s housing market stayed hot, creating opportunities and fierce competition for people with the means to buy, but also leaving residents on the brink of eviction with higher prices and fewer options.

“There isn’t the same availability of housing to match the demand,” Bennet says. “That’s really driven up property values. Landlords and property management companies know they can charge more for rent, so they do.”

Fort Wayne has frequently been rated as one of the best cities to own investment property in, and that attracts residents and investors from across the country who often have no personal ties to the city. This contributes to the rise in property and rental prices.

“There are a lot of out-of-state investors from places like California and New York who have zero connections here,” says Bennett. “Housing laws are such that you can’t discriminate against someone just because they’re from out-of-state, but when you have no connection to the community, you’re less likely to care about it. They’re trying to be a smart investor and get the most bang for their buck, but it hurts the people who live here.”

Bennett suggests those higher rents that property owners are able to charge have contributed to the eviction crisis at hand, made even worse because of COVID. Nationally, about half of all rentals are owned by large business entities while the other half is owned by individuals with single units, houses, and duplexes. The CARES Act tax provisions, though, are structured in a way that significantly benefits the already wealthy businesses rather than the small-time landlords and property owners.

Many smaller landlords relying on their rental properties for income are caught in the dilemma of charging higher rents, relying on rental income to pay the mortgages on their rental properties, and not being able to evict tenants because of federal, state, and local moratoriums.

“It’s alarming how many people think they can be a property flipper or property owner,” Bennett says. “I’m not here to tell people they can’t, but I believe they should only qualify for a loan if they can afford to make that payment in the event that they had no renter.”

Still, there are plenty of landlords who are dependent on rental income to make their mortgage payments and because of the current eviction protections, these smaller landlords are in a bind, looking to evict tenants as soon as they can. ABC21 WPTA reported in August that “Allen County court leaders estimate 600 eviction cases are pending right now that have been filed since April.”

While remaining optimistic, Bennett has his share of concerns, like: What happens when all the protections are gone, and people have to start paying off debts that had been deferred for the last six months?

Even though Fort Wayne’s housing market has been booming and appears to be attracting more out of town homebuyers during the pandemic, he’s concerned about what that will mean for the residents already living in the city and struggling to make ends meet.

“It’s great that we’re attracting new people to the city, but are we also bringing the bottom up for the people already living here?” he asks. “Are we bringing in the types of jobs that allow people to establish themselves and move up? Are we driving out people who already live here, pricing them out of their neighborhoods? Is the whole community keeping up?”

One local organization that deals with the fallout of some of these questions is Indiana Legal Services, Inc. (ILS) which has a tenant assistance legal clinic that provides eligible low-income residents with help ranging from advice to legal representation.

“Indiana is one of the most landlord-friendly states in terms of the laws,” says Andrew Thomas, Attorney with ILS. “There are some things that make it harder for a tenant in Indiana. For instance, the requirements for a notice before a landlord files eviction are a little unclear. Unlike in other states, in Indiana, you cannot withhold your rent if your place is uninhabitable or has not been repaired.”

For tenants who get behind in their rent, the cards can stack up against them quickly. Once a person gets evicted from their home, or even has an eviction filed against them, it can stay with them for life, often making it harder for them to find future housing.

“An eviction can wreck a person’s record,” Thomas says. “It can wreck their credit. It can wreck their ability to get employment. It can wreck their ability to get almost any kind of benefit, especially if they become homeless.”

Here in Indiana, an eviction is public record, so anyone can look up the case, and landlords will always be able to see an eviction on a person’s record. There are no expungement laws that can remove an eviction from a person’s record or have it sealed, so an eviction doesn’t go away.

“I often see people who have problems vacating their property,” Thomas says, “simply because an eviction has been filed on them, creating a catch-22 where they want to leave, and the landlord wants them to leave, but they can’t leave because no one will rent to them because of the eviction.”

Due to COVID and other current events, the future of housing and evictions in Fort Wayne is uncertain. Thomas believes evictions are probably going to be coming in waves. In August, there was a wave of evictions because the moratorium from the state ended, and the federal moratorium ended in July. The current moratorium is keeping some evictions from being filed until next year, which may create another wave then.

For Thomas, it’s hard to predict what may happen with housing if there’s a resurgence in the virus, too. But as Northeast Indiana residents navigate the changes, there is help, Bennett notes.

“If you are a tenant, and you’re behind on rent and need rental assistance, which has happened to many people this year, there are places you can go,” he says.

One is Indiana Housing Now, which has a rental assistance program, covering $500 per month for up to six months. The local nonprofit Brightpoint funds various assistance programs to help people with rent or even transition into new housing. Various township trustee offices can provide assistance to renters, too. Catholic Charities and various churches have also taken a proactive role in providing financial help on a case-by-case basis. There is also the current federal moratorium under the CDC that renters can apply for.

Like Bennet, Thomas finds himself often needing to remind residents on the brink of eviction that there are resources that can help them—and the sooner they reach out, the better.

“People should be seeking assistance as soon as they are behind in rent,” he says. “They should not wait, and they should be persistent in getting that help before any eviction is filed because it can have a negative impact on the person’s ability to rent in the future.”

Learn more

This is one of two stories in a “Housing & COVID-19” series by Input Fort Wayne. Read the other story about how Fort Wayne’s housing market is heating up in 2020.